All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Holding cash in an IUL repaired account being credited interest can typically be much better than holding the money on down payment at a bank.: You've always dreamed of opening your own bakery. You can borrow from your IUL plan to cover the preliminary expenditures of renting an area, buying equipment, and hiring team.

Credit rating cards can supply a versatile means to obtain money for really short-term periods. Obtaining money on a credit score card is typically extremely costly with annual percentage prices of interest (APR) typically reaching 20% to 30% or more a year.

The tax therapy of policy finances can differ dramatically relying on your nation of home and the details regards to your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan loans are usually tax-free, using a significant advantage. Nonetheless, in various other territories, there may be tax implications to think about, such as prospective taxes on the funding.

Term life insurance coverage just supplies a death benefit, without any type of cash money value build-up. This implies there's no cash money value to obtain against.

Become Your Own Bank Today! It's A Strategy That Many Have ...

Think of stepping into the financial cosmos where you're the master of your domain, crafting your very own course with the finesse of a skilled banker however without the restrictions of towering establishments. Welcome to the globe of Infinite Banking, where your monetary fate is not just a possibility however a concrete reality.

Uncategorized Feb 25, 2025 Money is among those things most of us manage, however many of us were never actually educated how to use it to our advantage. We're informed to conserve, spend, and spending plan, however the system we operate in is made to keep us based on financial institutions, constantly paying passion and fees simply to accessibility our very own cash.

She's a specialist in Infinite Financial, a method that aids you take back control of your finances and construct real, enduring wide range. It's an actual strategy that affluent families like the Rockefellers and Rothschilds have actually been making use of for generations.

Now, before you roll your eyes and think, Wait, life insurance policy? That's boring.stay with me. This isn't the type of life insurance the majority of people have. This is a high-cash-value plan that allows you to: Shop your cash in an area where it expands tax-free Borrow versus it whenever you need to make investments or major acquisitions Make uninterrupted substance passion on your cash, also when you borrow against it Think of just how a bank functions.

With Infinite Financial, you end up being the bank, making that interest instead of paying it. For most of us, cash moves out of our hands the second we get it.

What Is Infinite Banking

The insurance provider doesn't need to obtain "repaid," since it will certainly just be subtracted from what obtains distributed to your recipients upon your expiration date, as Hannah so euphemistically called it. You pay on your own back with interest, much like a bank wouldbut now, you're the one making money. Allow that sink in.

It's regarding redirecting your cash in a way that builds wide range instead of draining it. Instead of going to a financial institution for a loan, you obtain from your very own plan for the down settlement.

You utilize the finance to get your residential or commercial property. That's what Hannah calls double-dippingand it's precisely how the wealthy maintain growing their money.

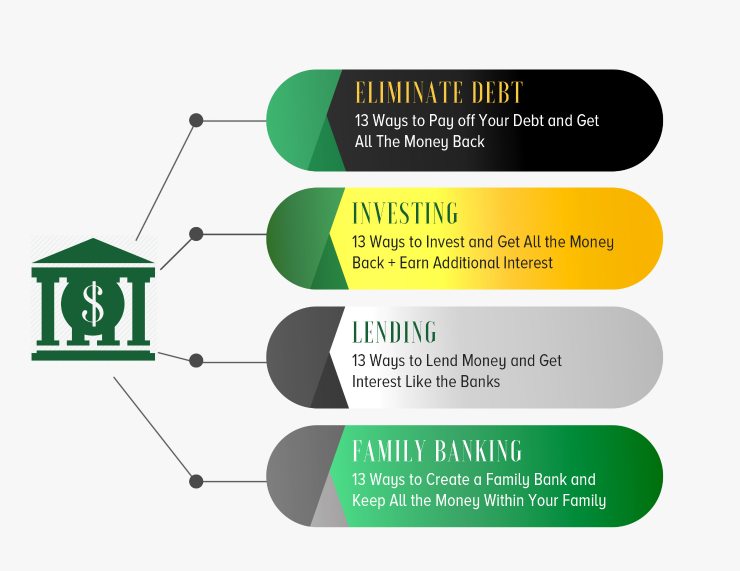

How To Make Your Own Bank

Below's the thingthis isn't an investment; it's a cost savings technique. Your cash is ensured to grow no issue what the supply market is doing. You can still spend in real estate, supplies, or businessesbut you run your money with your plan initially, so it maintains growing while you spend.

We've been trained to think that financial institutions hold the power, yet the fact isyou can take that power back. Hannah's family has been using this method given that 2008, and they now have over 38 policies moneying actual estate, financial investments, and their family's monetary legacy.

Becoming Your Own Lender is a text for a ten-hour training course of direction about the power of dividend-paying whole life insurance coverage. The industry has actually concentrated on the death advantage top qualities of the contract and has ignored to sufficiently define the funding abilities that it presents for the policy owners.

This book demonstrates that your demand for finance, throughout your lifetime, is much greater than your demand for defense. Resolve for this need via this instrument and you will end up with even more life insurance policy than the business will issue on you. Many every person recognizes with the fact that can borrow from a whole life plan, yet due to just how little costs they pay, there is minimal accessibility to cash to fund major things needed throughout a lifetime.

Truly, all this publication includes in the formula is scale.

Latest Posts

Infinite Banking Insurance Policy

Infinite Banking Toolkit

Using Whole Life Insurance As A Bank